M-Finance CEO Dick Tam meets with Andrew Saks-McLeod at iFXEXPO Asia 2016, Hong KongFor many western brokerages, attempting to gain a toehold within China’s vast retail FX business is presents a dichotomy in that it is both a top priority and an enigma.

Many firms that have substantial IB networks in China are the large American companies such as FXCM and GAIN Capital, companies that have fostered longstanding relationships with large, plate-glass IBs and portfolio managers in Tier 2 development cities such as Shenzhen, Zhengzhou and Guangdong.

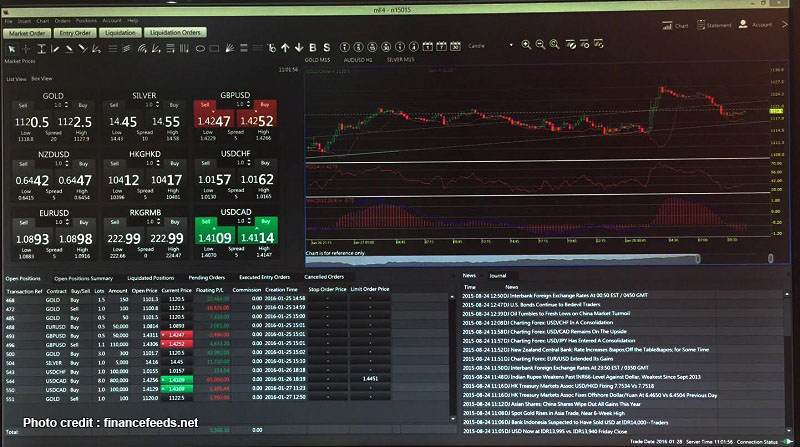

From a Western perspective, an aspect that has been less of a consideration is the platform which is provided to Chinese brokerages, with many firms sticking firmly to the ubiquitous MetaTrader 4 platform and laboring under the adage that it is suited to expert advisers (EAs) that are the darling of Chinese traders.

Is this still the case?

Today, here in Hong Kong, at the iFXEXPO Asia 2016 which is hosted by ConversionPros in conjunction with Finance Magnates, the platform vendors are indeed varied in their modus operandi.

FinanceFeeds CEO Andrew Saks-McLeod spoke to Dick Tam, CEO of M-Finance, which is a platform provider based in Hong Kong, serving brokerages across the Asia Pacific region, with most of the retail clients of said brokerages being based in mainland China.

Mr. Tam explained that M-Finance provides a proprietary platform, and has been established for 13 years, dispelling the widely held opinion that MetaTrader 4 is an absolute must for gaining prominence in China.

Pirate or genuine?

Mr. Tam explained a very interesting matter with regard to platform technology which is provided to Chinese firms, in that due to the restrictions on internet access to and from outside mainland China, licensing issues are the source of great concern.

Besides, the language we support English, Traditional Chinese, and translation to localize it with translation compared to off the shelf platforms so many chinese people cannot understand the Chinese that has been made as a translation.

“The MetaTrader 4 platform has alot of users in China” explained Mr. Tam. “However something very important to consider is that many traders in China are using pirated copies of MetaTrader 4 because they can easily copy the software.””Many people find ‘holes’ in the platform and are able to copy it, and then the vendor blocks it, and it becomes an ongoing battle between software vendor and end user as far as pirating is concerned” he said.

“We ensure that this cannot happen because we do not open the platform up for developers to create their own applications or ancilary software. We do not have an open source code, nor do we have a ready API for developers, so we are more conservative and therefore more secure” – Dick Tam, CEO, M-Finance.

“The main difference in how we operate our business is that MetaTrader 4 is very strong on its front end, is very user friendly and developers can write any tools to help them. Therefore, we take the view that MetaTrader 4 is designed for end users, but brokers see things differently to how end users do. Brokers want a system that can help them manage their risk. We have a very comprehensive back office system so that brokers can manage risk, control user behavior, and manage campaigns” he said.

“When operating in China, language support is vital. Many off-the-shelf platform vendors do not consider the quality of translation between other languages and Chinese, therefore it is hard for Chinese users to understand the Chinese language options on platforms. We have standard, traditional Chinese and this is more practical in the local market” said Mr. Tam.

“Customization is important, as many firms in China want to tailor their platform to suit their own business needs. For example, many portfolio management companies have different requirements to algo trading firms, or for example those who trade FX or commodities such as bullion or oil” he said.”We charge the platform to brokers via two business models. One is that we charge a monthly maintenence fee, for which we offer 7 day a week, 24 hour a day support, and another method is to base the capitalization on trading volume. It is not uncommon for one broker which uses our software to produce $8 billion per month in volume” explained Mr. Tam.

From 2015, we began offering a liquidity service to brokerages. There are many professional traders in China who can make a lot of money from B-book brokers, meaning that the broker loses. We now have FIX Protocol so that we are connected to many banks internationally in order that brokers can send their order flow to banks if there are orders that they don’t want to handle. This type of service can be charged on a transaction basis” he concluded.

文章来源:FinanceFeeds